Few products are as misunderstood as biofertilizer.

Something that CropLife magazine believes stems from, “… some confusion as to what constitutes a biofertilizer vs. a biostimulant.” Explaining that, “Biofertilizers are defined as microorganisms such as bacteria and fungi that can increase nutrient availability and utilization by plants. They are oftentimes referred to as a ‘sub-category’ of biostimulants.”

In fact, at this point it is worth clarifying exactly how this ‘sub-category’ of biostimulants works.

Jane Fife, Chief Science Officer for 3Bar Biologics, does this by stating that, “Common examples of biofertilizers include mycorrhizai fungi, rhizobium, and plant growth promoting rhizobacteria (PGPR). These microbes can help plants fix atmospheric nitrogen, soluble phosphorus, and/or produce phytohormones for evoking plant responses.”

While the science behind these products is clear, dispelling the myths and misconceptions is not easy.

Farmers, as a species, can be very set in their ways. Many have farmed the same way for decades and are content to follow the methods that worked for their fathers, their grandfathers, and maybe even their great-grandfathers.

But myths are being quashed, misconceptions adjusted, and slowly, farmers are beginning to have a better appreciation of soil science and how biofertilizers can improve productivity.

As Dr Chris Underwood, a chemist and Research And Development Manager at Custom Agronomics, describes, “Previously, most growers knew [biofertilizers] as ‘snake oil’ or ‘bugs in a jar,’ but that perception seems to be shifting. Until five to 10 years ago, most people did not realize how these products worked inside the plant or in the soil. Or if they did understand the benefits of these products, they also knew they were expensive, messy, and difficult to use.”

But times are changing, and farmers have begun to see the benefits in the microbiology of farming. This has been boosted by an ever-greater necessity for improving margins.

As Underwood acknowledges, “Now, growers have a renewed interest in what’s happening below the soil surface. Farmers are looking at ways to improve the biological activity in their soil, and fertilizer products that incorporate organic matter, beneficial fungi, bacteria, and microbes will help them meet their yield goals and improve their soil vitality.”

Explaining the science, especially in developing countries, can be a challenge, as Rashtrasant Tukadoji, a biofertilizer supplier from India, describes, “I went to farmers to communicate with them, and they replied that they are happy with chemical fertilizers, and questioned why they should change to biofertilizers. When I gave examples of the improvements that biofertilizer can make, they didn't understand the technical language as they are not well educated, they are just results-oriented.”

Even in developed countries, improving biofertilizer uptake has been an uphill struggle. Despite the best efforts of the biofertilizer industry sales remain stagnant, with larger, well-educated markets such as the US seeing only minor market growth in 2018 from the $1 billion of biofertilizer products sold in 2010. Specifically, market watchers note that the Midwestern row crop market has been especially slow to adopt biofertilizer technology.

But many industry insiders believe that this is due to short-term economics, not a fear of anything new. As Murray Van Zeggelaar, Vice President of NACHURS, a major fertilizer producer for the North American market, explains, “I would suggest that adoption in the Midwest row crop market has been slow, however, the main reason for this has been the current commodity price cycle we are in. There’s still a healthy return-on-investment on these products at low grain prices, but many growers have been forced by their lending institutions to spend less per acre on crop inputs. This has forced a lot of growers to look for ways to cut costs, and biofertilizer products have been victims of that.”

As economic cycles adjust, trade war tariffs are lifted, and the farm product price cycle shifts upwards, then it is believed that the case for using biofertilizers will be revisited.

Certainly, the scientific case for employing biofertilizers is getting stronger.

To learn more about the advantages of biofertilizers read The Pros and Cons of Biofertilizers and Are Biofertilizers Effective?

Research is also continuing to provide improved biofertilizer products, some with solutions to problems in large markets, such as the water deficient agriculture of California or Western Australia.

To learn more about how biofertilizers can assist in drier climates read Biofertilizer Boosts even Drought Affected Crops.

While field tests and farmers personal experiences with improved yields from biofertilizers are also providing clear evidence of their power.

To learn more read The Farmers taking Biofertilizer Testing into their Own Hands.

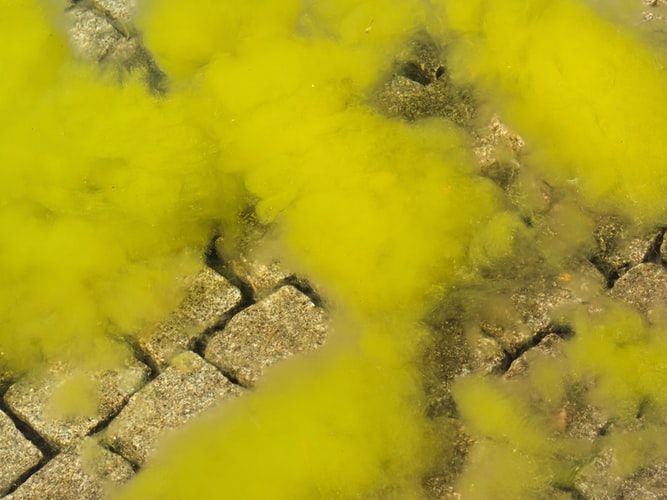

Given these strengths and the continued political and public concerns over environmental health (emissions from conventional fertilizer production, algal blooming from phosphate and nitrogen run off, and general soil health, as well as expanding demand for organic farm products), it is little wonder that more and more fertilizer market analysts are predicting a boom in the biofertilizer sector over the coming years.

As a recent study conducted by the agricultural research firm DunhamTrimmer, states, “The overall biologicals market could increase to $11 billion by the year 2025. Microbials - a major part of the biofertilizers segment - have traditionally been the fastest growing sector of the market, holding an approximate 60% market share vs. macro-organisms and biochemicals. This is expected to remain the case through 2025.”

From here the case seems made; for those who have not yet taken a look at biofertilizer products, now, it seems, is the best time; and for those who have already considered them, now seems the best time to re-examine the data.

Given biofertilizers multi-decade history, it is strange that many biofertilizer manufacturers still feel like the market is only just emerging. As Dr Underwood states, “Considering some of these products have actually been around for over 20 years, only now are we starting to recognize their potential.”

Photo credit: Indiamart, Pedchem, Sustainablefoodtrust, Feeco, Soilsmatter, & Wbfo